Housing Options and Evaluations

For Westchester Seniors and Their Families

An essential component of retirement is the planning and assessment of housing for senior citizens.

You could be wondering whether to age in place or sell your house as you get closer to retirement. Is it safe for me to age at home?

About 60% of baby boomers who sell their homes also buy new ones, according to trends, but just 40% of silent generation sellers do the same. They need to assess their financial situation in order to find housing options. Considerations like your financial situation, the housing market in your new area, your familiarity with the neighborhood, the location of your family support network, and your level of confidence that this is your final move or a transition home should all be taken into account when thinking about selling your house.

Is it safe for me to age at home?

It’s crucial to assess whether your house is secure and suitable for you if you’re thinking about aging in place. Your home can be made more accessible by building a walk-in shower or bathtub, changing the flooring, or adding handrails. AIM LLC, a Senior Real Estate Specialist, may provide a home safety assessment if you’re worried about your house’s security.

Let’s explore senior housing options:

Aging in Place:

Definition:

Remaining in your current home as you age.

Details:

Modify your home for safety and accessibility, allowing you to stay comfortably.

Benefits:

Familiar surroundings, independence, and community connections.

Independent Living Communities:

Definition:

Residential communities for active seniors.

Details:

Private apartments or cottages with amenities (e.g., meals, housekeeping).

Benefits:

Social engagement, maintenance-free living.

Assisted Living Facilities:

Definition:

Residential settings with support services.

Details:

Assistance with daily tasks (e.g., bathing, medication).

Benefits:

Personalized care, social activities.

Nursing Homes (Skilled Nursing Facilities):

Definition:

24/7 medical care for seniors with complex needs.

Details:

Licensed nurses, rehabilitation services.

Benefits:

Intensive care, specialized programs.

Continuing Care Retirement Communities

Definition:

Combines independent living, assisted living, and nursing care.

Details:

Residents transition seamlessly as needs change.

Benefits:

Long-term planning, community amenities.

Subsidized Housing:

Definition:

Affordable housing options for low-income seniors.

Details:

Rent based on income, often government-subsidized.

Benefits:

Financial relief, community support.

Nursing Home And Assisted Living

Evaluations

Evaluating nursing homes and assisted living facilities is crucial to ensure the well-being and quality of care for residents. Below, I’ve compiled a list of questions that you can include in your evaluation form. Feel free to customize and adapt them to your specific needs:

General Information:

- Facility name and address

- Contact information (phone, email)

- Date of assessment

Admission and Eligibility:

- What criteria are used for admitting residents?

- Are there any specific health conditions or limitations for admission?

Staffing and Training:

- How many staff members are available per resident?

- What qualifications and training do staff members have?

- Is there a registered nurse on-site?

Resident Care and Services:

- How are residents’ daily needs (such as bathing, dressing, and medication management) met?

- Are there specialized services for memory care or other specific conditions?

- How is social engagement and recreational activities facilitated?

Health and Safety:

- How are emergencies handled? Is there a disaster preparedness plan?

- What safety measures are in place (e.g., fall prevention, fire safety)?

- Is there a process for reporting incidents or complain

Nutrition and Meals:

- How are meals planned and provided?

- Are dietary restrictions accommodated?

- s there a registered dietitian overseeing meal planning?

Physical Environment:

- Is the facility clean and well-maintained?

- How are residents’ rooms furnished?

- Is there a registered dietitian overseeing meal planning?

Quality of Life:

- How does the facility promote residents’ independence and dignity?

- Are there opportunities for social interaction and community involvement?

- How are residents’ preferences and choices respected?

Financial Considerations:

- What are the costs and payment options?

- Are there additional fees for specific services?

- Is there a refund policy for early discharge?

Family and Resident Involvement:

- How are families involved in care planning and decision-making?

- Are there regular family meetings or communication channels?

- How does the facility address family concerns?

Long Term Care Planning

Estate planning and long-term care planning are essential for senior citizens.

Estate planning involves reviewing a collection of legal documents that outline what should happen to one’s estate upon their death and while they are still alive. It includes wills, trusts, power of attorney, and more. It can be as simple as designating a proxy to make health care decisions on your behalf. We offer free health care proxies and aging disposition to all of our clients. They do not require an attorney; they are state forms.

Long-term care planning, on the other hand, involves preparing for the possibility of long-term care, which can exert a significant strain on seniors, their families, and their finances. It is prudent to strategize early by evaluating current health risks and family history to gauge the probability of future impairment, researching estimated costs using long-term care insurance needs calculator, and talking to professionals.

Estate planning and long-term care planning are also important aspects of housing planning for senior citizens. Do you want to transfer the house to a family member? How does owning a home effect Eligibility for government programs such as Medicaid?

ASM can explain Medicaid eligibility and how you may become eligible with strategic planning. AIM LLC plans with both experience and empathy to give guidance and solutions to these issues.

Care or Companionship?

Chances are most of us will need help at some point in our lives. In fact, those age 65 and older have a 70% chance of needing long-term care services at some point, according to the U.S. Department of Health and Human Services.

Where will that care come from?

Relying on family to care for you is an appealing option. You have their love and trust, and it’s comforting to know they would care for you and ensure your well-being.

At what cost?

But what many don’t consider is the difference between a companion and a caregiver. Having family to assist you is great, but studies show that relying on them day in and day out for your personal care takes a toll on their physical and emotional health. Family members who work and provide caregiving services for a loved one are much more likely to suffer from stress, anxiety, or depression than those who aren’t caregivers.

Plus, many caregivers suffer long-term work and financial consequences from providing care. The majority of caregivers reported missing work or being late because of their caregiving responsibilities.2 In addition, 71% of caregivers say their financial contributions cause them stress, and many contribute even though the cost could put their own financial future in jeopardy. In fact, one-third had to cut back on their own expenses.

The Solution Planning or

Long-term care insurance is a good solution to this problem. It generally pays for care when you need it and where you’d like to receive it. The majority of people who rely on care as they age get that care at home. Long-term care insurance can pay for a wide range of care, from help with housework to visits from a nurse to care in an assisted living or nursing facility, if needed.

Long-term care insurance gives you options and allows your loved ones to spend quality time—not caregiver time—with you.

One of the greatest potential risks faced by America’s elderly is the need for long-term care.

Long-term care insurance transfers a portion of the risk of long-term care expenses to an insurance company helping to protect you and your family from potentially devastating expenses.

Did You Know?

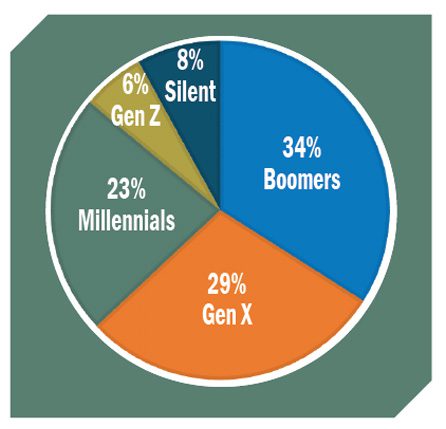

Who are today’s family caregivers?*

Adult Day Care Community Day Care

Features:

- Part-Time Care in a Group Setting

- Social Interaction and Security

Assisted Living Facility Adult Foster Home Residential Health Care Apartment-Like Conditions

Features:

- Personal Care Assistance

- Non-Skilled Care Services

Nursing Facility Nursing Home Institutional Care Facility (Due To Necessity)

Features:

- Skilled Care

- Intermediate Care

- Custodial Care

Hospice Care End Of Life For The Terminally Ill (Six Months)

Features:

- Skilled Care

- Intermediate Care

- Custodial Care

Home Health Care In-Home Care

Features:

- Homemaker Services

- Personal Care

- Nursing Services: RN, LPN, Health Care Aide, Personal Care Aide

- Therapy Services: Speech, Respiratory, Physical

*Caregiving in the U.S. 2020, National Alliance for Caregiving and AARP

These materials are provided for educational purposes only and do not constitute the solicitation of an insurance product to the public. For use with non registered products only. Products and programs offered through Crump are issued by various insurance companies and may not be available in all states. Policy terms, conditions and limitations will apply. Not all applicants will qualify for coverage. You can obtain more information about insurance products by contacting your insurance agent. Crump makes no representation regarding the suitability of a particular insurance product to your needs.

Remember to choose the option that aligns with your needs, preferences, and budget.

As we age, we demand specialists for our health needs, so why not for our housing needs as well? Aging Issues Management helps senior citizens with family financial decisions related to housing and the effects on retirement.

Deciding To Relocate Or An Age-In-Place? We Can Help.

We provide support with financial decisions before, during, and after the sale of a family residence. In the case of Aging-In-Place, we can recommend ideal renovations to create a barrier-free environment for those who have mobility difficulties. We do our best to create a harmonious and seamless blending of efforts during this stressful time.

WE CAN PROVIDE IDEAS ON:

WhereYouLiveMatters.org is an excellent resource for learning about senior housing options, including family and lifestyle decisions related to housing.

Modern Ideas, Modern Living: Home Design and Planning for the Lifestyle You Want discusses people’s changing environmental needs and wants with age, examines elements of the age-friendly home and neighborhood, and provides checklists for homeowners thinking about the future.

Simple Solutions: Practical Ideas and Products to Enhance Independent Living is a guidebook featuring more than 200 simple design ideas and household products that can make your home more comfortable, convenient and safe.

Fire Sense: A Smart Way to Prevent, Detect and Escape Home Fires Fire safety is not a one-time project. You must continually be on guard against the fire hazards in your home. This valuable booklet can help you and your family prevent, detect and escape home fires.