Our golden years should be a time of peace and relaxation, not a constant battle against scams. Unfortunately, for many seniors in Westchester County, this isn’t the case. Financial predators are actively targeting our elderly loved ones, using sophisticated and heartless tactics to steal their hard-earned money. But knowledge is power. By understanding the common scams and knowing how to respond, we can build a strong defense for our parents and the entire senior community.

This blog post will shine a light on the most prevalent financial scams in our area and provide actionable solutions for how families can protect their parents from fraud.

The Hidden Epidemic: Senior Financial Fraud in Westchester

Financial scams targeting seniors are a pervasive and often underreported crime. Older adults are attractive targets for several reasons: they often have accumulated wealth, may be more trusting, and might be less familiar with the latest digital scams. The consequences of this exploitation extend far beyond monetary loss, often leading to emotional distress, loss of independence, and a diminished quality of life. In Westchester County, a community with a significant senior population, the risk is particularly acute.

Common Scams Targeting Westchester Seniors

Fraudsters are constantly evolving their methods, but several types of scams are consistently reported in our area. Awareness is the first line of defense.

The Alarming Rise of Government Impersonation Scams

One of the most intimidating scams involves fraudsters posing as officials from government agencies like the IRS, Social Security Administration, or even local law enforcement. Scammers have even spoofed the phone numbers of the New York State Department of Taxation and Finance to appear legitimate.

How it Works:

A senior will receive a call, email, or text message claiming they owe back taxes, have a problem with their Social Security benefits, or have a warrant out for their arrest. The scammers use fear and urgency, threatening legal action or the loss of benefits to pressure their victims into providing personal information or making immediate payments, often through wire transfers or gift cards. Recently, scammers in Westchester County have even pretended to be from a non-existent “Westchester County Sheriff’s Office” to demand payment for supposedly missed jury duty.

Solutions:

- Verify, Verify, Verify: Government agencies will never demand immediate payment over the phone or ask for payment via gift cards or wire transfers. Hang up and call the agency directly using a number from their official website to verify the claim.

- Never Give Personal Information: Do not provide or confirm any personal or financial information in response to an unsolicited call or message.

- Report It: Report any suspicious contact to the Westchester County District Attorney’s Office and the Federal Trade Commission (FTC).

The Heartbreaking “Grandparent Scam”

This cruel scam preys on a grandparent’s love and instinct to protect their grandchildren. The Westchester County District Attorney’s Office has issued multiple warnings about this prevalent scheme.

How it Works:

A grandparent receives a frantic phone call from someone pretending to be their grandchild. The “grandchild” claims to be in trouble—often in a foreign country—and in desperate need of money for bail, medical expenses, or a lawyer. They will often plead with the grandparent not to tell their parents to maintain secrecy. Scammers may even use details gleaned from social media to make their story more convincing. In Westchester, there have been recent arrests in connection with this scam, with victims losing thousands of dollars.

Solutions:

- Ask a Question Only Your Real Grandchild Would Know: If you receive a suspicious call, ask a personal question that a stranger couldn’t answer.

- Hang Up and Call a Family Member: Independently verify the grandchild’s whereabouts by calling them directly or another family member.

- Resist the Urge to Act Immediately: Scammers create a sense of urgency to prevent you from thinking clearly. Take a moment to pause and investigate.

Beware of Home Improvement and Deed Scams

Seniors who are homeowners can be prime targets for fraudulent contractors and deceptive deed solicitations. These scams can lead to significant financial loss and even the loss of their homes.

How it Works:

Seniors who are homeowners are often targets for unscrupulous contractors. These individuals may show up uninvited, offering services at a suspiciously low price for jobs like driveway paving or roof repair. They often pressure the homeowner to make a quick decision and may demand a significant upfront payment before disappearing without completing the work, or performing it with substandard materials. In Westchester, all home improvement contractors are required to be licensed, and homeowners should always verify a contractor’s credentials before hiring them.

A more insidious threat is deed theft. Scammers can use publicly available information to forge a homeowner’s signature on a new deed, effectively stealing the title to their property. Seniors, who are more likely to own their homes outright, are prime targets for this devastating crime. Warning signs include receiving unfamiliar bills or notices of default on a mortgage that is paid off.

Solutions:

- Get Multiple Written Estimates: Always get at least three written estimates from reputable, licensed, and insured contractors.

- Never Pay in Full Upfront: Agree on a payment schedule and never pay the full amount before the work is completed to your satisfaction.

- Check with the County Clerk: For any questions about your property deed, contact the Westchester County Clerk’s office directly.

Navigating Medical Alert and Healthcare Fraud

Scammers often exploit seniors’ health concerns to perpetrate fraud. This can range from selling unnecessary medical alert systems to billing for services never rendered.

How it Works:

Taking advantage of seniors’ health concerns, scammers will make unsolicited calls offering “free” medical alert systems. They may falsely claim to be from Medicare or another trusted health organization. The catch is that they will ask for credit card information for “shipping” or “monitoring” fees, which then leads to fraudulent charges. The New York State Department of State has issued specific warnings about these robocalls.

Healthcare fraud can also involve perpetrators posing as Medicare representatives to trick seniors into revealing personal information. This information is then used for identity theft or to bill Medicare for services that were never provided.

Solutions:

- Be Wary of “Free” Offers: If an offer sounds too good to be true, it probably is. Never provide your credit card number for a “free” product or service.

- Protect Your Medicare Number: Treat your Medicare card like a credit card. Don’t share it with anyone who contacts you unexpectedly.

- Review Your Medical Bills: Carefully review all medical bills and statements to ensure you were not charged for services or equipment you did not receive.

Spotting Investment and Affinity Fraud

Seniors, with their accumulated life savings, are prime targets for investment scams. These schemes often promise high returns with little to no risk, a major red flag. Scammers may use tactics like “investment seminars” with free lunches to pressure attendees into purchasing unsuitable financial products.

Westchester County, with its affluent communities, has seen its share of investment scams, including Ponzi schemes and affinity fraud. Affinity fraud specifically targets members of identifiable groups, such as religious or ethnic communities.

How it Works:

Fraudsters, who may even be members of the same group, will promote an investment opportunity with the promise of high returns and little to no risk. They use the trust and social connections within the group to lure in new investors. These schemes often turn out to be Ponzi schemes, where money from new investors is used to pay earlier investors, creating the illusion of a profitable enterprise. Several high-profile Ponzi schemes have been uncovered in Westchester, defrauding dozens of families out of millions of dollars.

Solutions:

- Be Skeptical of Guaranteed High Returns: Every investment carries some level of risk. Be wary of anyone promising guaranteed high returns.

- Don’t Let Friendship Cloud Your Judgment: Even if the person promoting the investment is a trusted friend or community leader, do your own due diligence.

- Verify with a Third Party: Before investing, consult with a trusted and independent financial advisor or lawyer.

How Family Can Help Protect Their Parents from Fraud

Family members play a crucial role in safeguarding their elderly loved ones from financial exploitation. Open communication and proactive measures are key.

Strategy and Actionable Steps to Help Your Parents Avoid Fraud

- Initiate Conversations About Scams: Regularly talk to your parents about common scams. Talking openly about the different types of scams can be one of the most effective prevention tools. If your parent is aware of the tactics scammers use, they are less likely to fall victim. Share news articles and resources to keep them aware of the latest tactics.

- Be Involved in Their Finances (with Permission): With your parents’ permission, help them regularly review their bank and credit card statements for any unusual activity. Offer to help with tasks like paying bills and reviewing bank statements. This can help you spot any unusual or unauthorized transactions early on. Services that monitor financial accounts and provide alerts can also be invaluable.

- Strengthen Their Digital and Phone Security: Develop a “Scam Plan” for how your parents will handle unsolicited calls or offers. This could include a script for saying “no” and a commitment to always consult with you before making a financial decision. Help your parents set their phones to send unknown callers to voicemail and adjust their social media privacy settings to be more restrictive. Adding their number to the National Do Not Call Registry can also reduce unwanted telemarketing calls.

- Secure Important Documents: Ensure important documents like their Social Security card, Medicare card, and financial records are stored securely.

- Establish a “Trusted Contact”: Many financial institutions allow account holders to designate a trusted contact person. This allows the institution to reach out to that individual if they notice suspicious activity on the account.

- Create a Support System: Encourage your parents to discuss any unsolicited offers or financial decisions with a trusted family member, friend, or financial advisor before taking any action.

- Know Who to Contact: If you suspect your parent has been the victim of a scam, report it immediately to their bank, local law enforcement, and the Federal Trade Commission (FTC). In Westchester, you can also contact the Department of Senior Programs and Services for assistance.

Local Resources for Westchester Seniors

Fortunately, Westchester County has dedicated resources to combat senior fraud and support victims.

- Westchester County District Attorney’s Office Elder Abuse Unit: This specialized unit investigates and prosecutes crimes against seniors. They can be reached at (914) 995-3000.

- Westchester County Department of Senior Programs and Services: This department offers a wealth of information and programs for seniors, including the “Senior Crime Busters” program, which educates seniors on how to recognize and avoid scams. Their helpline is (914) 813-6300.

- Westchester County Department of Consumer Protection: If you suspect a fraudulent call or business practice, you can contact them at Westchester County Department of Consumer Protection.

By working together, we can create a safer environment for our senior community in Westchester County. Let’s empower our parents with the knowledge and support they need to stay financially secure.

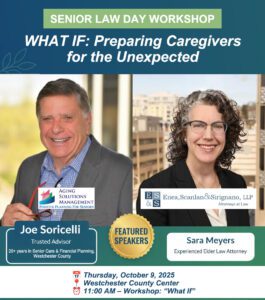

Why Choose Our Team at Aging Solutions Management as Your Specialists for Senior Financial Fraud in Westchester, NY

Navigating the complexities of senior financial protection can be overwhelming. That’s where a dedicated team of specialists can make all the difference. At Aging Solutions Management, our mission is to help individuals and families in Westchester plan better to live better.

Led by Joe Soricelli, an independent consultant with over 30 years of experience in financial and real estate planning, our team is uniquely equipped to address the challenges facing today’s seniors. We understand the four stages of retirement and the importance of proactive planning to ensure a secure and comfortable future.

One of our key areas of focus is fraud prevention. We believe that education is a powerful tool in combating senior financial fraud. Our team regularly gives presentations on a wide array of aging issues, including fraud prevention, to empower seniors and their families with the knowledge they need to protect themselves. We can also conduct home safety evaluations to help seniors age in place safely, reducing their vulnerability to home improvement scams.

At Aging Solutions Management, we provide personalized and compassionate guidance. We take the time to understand each client’s unique circumstances and develop customized plans to meet their specific needs. Whether you need assistance with financial and income planning, estate and long-term care planning, or housing planning, our team is here to help you navigate these important decisions with confidence.

If you are concerned about senior financial fraud in Westchester, NY, and are looking for a trusted partner to help protect your loved ones, we encourage you to contact us. It’s never too early or too late to put a solid plan in place. Let us help you and your family achieve the peace of mind you deserve. You can reach us at 914.468.0185 or Joe@AgingSolutionsNY.com.

Take Action Today!

Don’t wait until it’s too late. Share this article with your friends and family to raise awareness about senior financial fraud in Westchester County. If you have any questions or concerns, or if you’d like to learn more about how Aging Solutions Management can help, please leave a comment below or contact us for a confidential consultation. Together, we can create a safer community for our seniors.